Tax increment financing isn’t the sexiest subject. It sounds wonky. But if you can get past what it is and get to how it is used, things get juicy. We find city greed, corporate welfare and an outrageous use of our tax dollars.

In short, tax increment financing (TIFs for short) are tax breaks and assistance from a city or state to finance a project. This is intended to create jobs and stimulate development in a neglected area.

Here’s a hypothetical example to make it clearer: say a city has a blighted area. It’s not producing any tax revenue and there is little residential or commercial use. That city would approach companies and offer them taxes exemptions on the materials to build a building in the blighted area. The city would offer the company a period of five to 30 years of tax free operation and to help pay for the building.

In theory, this costs neither party anything of substance. The city collects tax revenues it wouldn’t have had otherwise after the agreed to five to 30 years and improves a blighted area. The company had to move, which is a pain, but it received lower taxes and a new building.

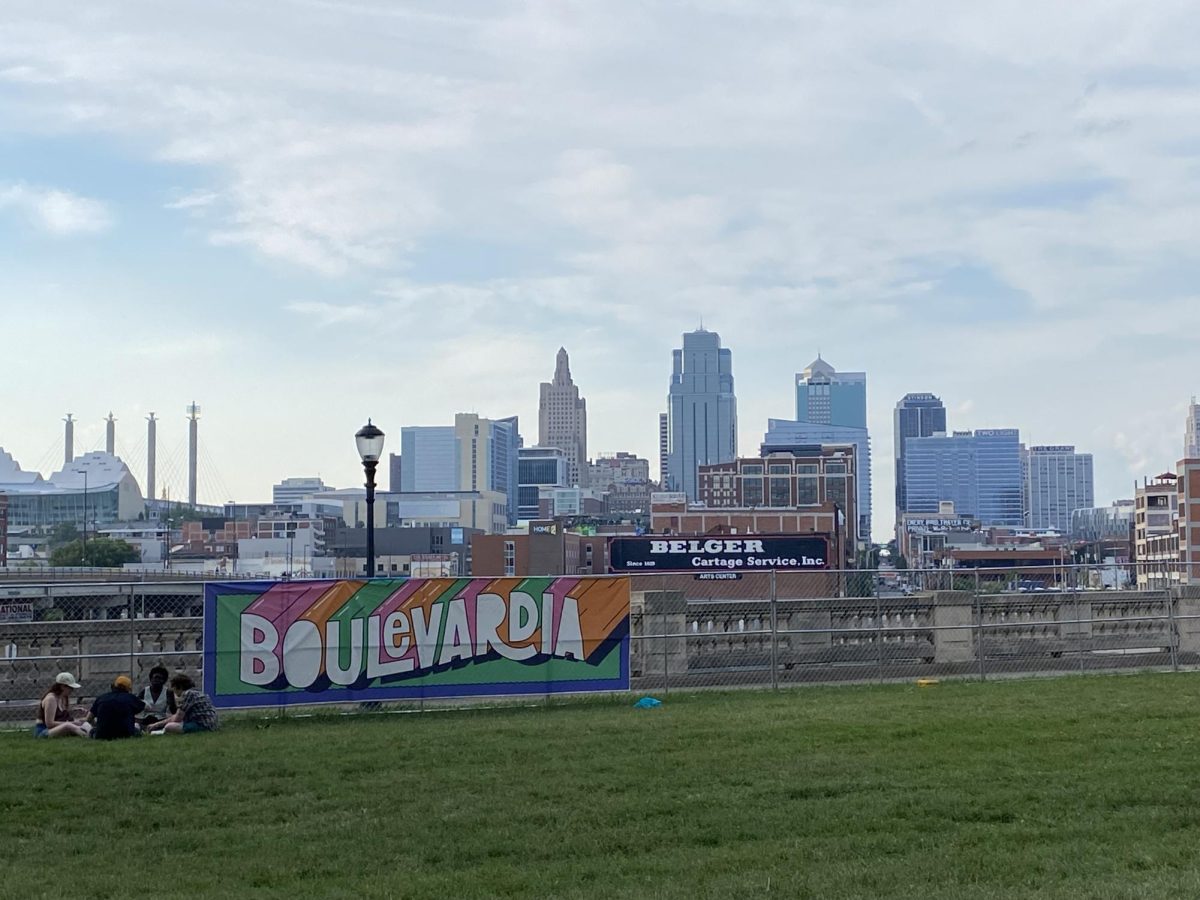

Sure, these arrangements can make some sense. But allow Kansas City to show you exactly how not to do TIFs.

According to reporting in The Kansas City Star, the city made a TIF agreement with Waddell & Reed, a financial firm. Kansas City gave $35 million in local incentives while the state of Missouri gave $62 million.

The tax-paying public altogether paid 70% of a $140 million building project in downtown. The building site at 14th and Baltimore, which would serve as a new main office for Wadell & Reed, is not exactly in a blighted area. There’s a half billion-dollar hotel across the street and an opera house two blocks away.

Ok, not awesome, but they are going to get a bunch of new spending in the area right? Not really.

Waddell and Reed was based in Overland Park. This means there’s not much of an additional economic impact to be had in Kansas City proper. While there would be some increased foot traffic, better sales for nearby coffee shops and lunch eateries, the metro area as a whole benefits nearly nothing.

This move came after governors agreed to not lure any more companies, essentially across the street, from Missouri to Kansas or vice versa. The two states had been engaged in a quiet war for tax dollars that ultimately hurt both states. HBO’s John Oliver made fun of KC for this practice, saying, “ That is not creating jobs any more than moving your couch from your bedroom to the living room is creating f- – -ing furniture.”

So why offer the TIF? The new building is not in a blighted area, the company already has a presence in the metro and jobs aren’t being created. They did it because KC was thirsty to get the 1% earnings tax from Waddell & Reed’s high-salary employees.

Ok, so the city will get the earnings tax, and the state will get more income from payroll tax which kind of, sort of, redeems the project, right? Wrong.

Waddell & Reed merged with Macquarie Group, an Australian company. The new corporate entity decided not to move to downtown Kansas City after all. The 18-story $140 million building project is still in construction but now has no purpose. As a cherry on top, 200 jobs were lost in the Overland Park office.

Kansas City is now building a ghost building and paying $32 million for it. Based on what? Greed.

There were signs that Waddell & Reed wasn’t doing well financially and may be purchased by another company. But the City Council was blinded by a fancy new building full of new parking spaces and high wage earners.

Now we are left holding the bag.

The mayor and City Council members are adamant that they will find another tenant. Good luck with that in a post-COVID world. Businesses have realized that they don’t really need expensive downtown office spaces when employees can work remotely.

This was a wasteful attempt to relocate money across state lines that cost the area dearly. Think of what $32 million could do for KC. Are there no potholes that need to be filled? Has economic racial equality been achieved? Is the east side of Main Street doing just as well as the west side? Do Kansas City public schools not need funding and accreditation?

Shame on all parties involved. Shame on Waddell & Reed for leveraging a locality to build an office for them. Shame on Kansas City and the state of Missouri for using TIFs antagonistically.

Kansas City Missouri took a money-grabbing gamble. It failed spectacularly. Political consequences need to follow.

Charles Gardner • Apr 18, 2021 at 12:44 am

$32 million is pocket change for the city. TIF’s just mean the property won’t pay full property taxes on the building not that taxpayer money has been handed to developers. KC public schools are well funded, and still under perform. Potholes seem to be getting address in the 1.7B dollar budget recently passed. The real question is how can Kansas City rid itself of NIMBY’s that hold our growth back? Maybe an ambitious leader like Sly James can carry the momentum.