Jasmine Jones and Adriana Macias

The COVID-19 pandemic has led to a dramatic increase in unemployment. According to the Department of Labor, over 26.5 million Americans have filed for unemployment since March 14, accounting for approximately 16% of the US labor force.

This rise in unemployment has harmed the economy and could prove worrisome for soon-to-be UMKC grads who are just entering the job market.

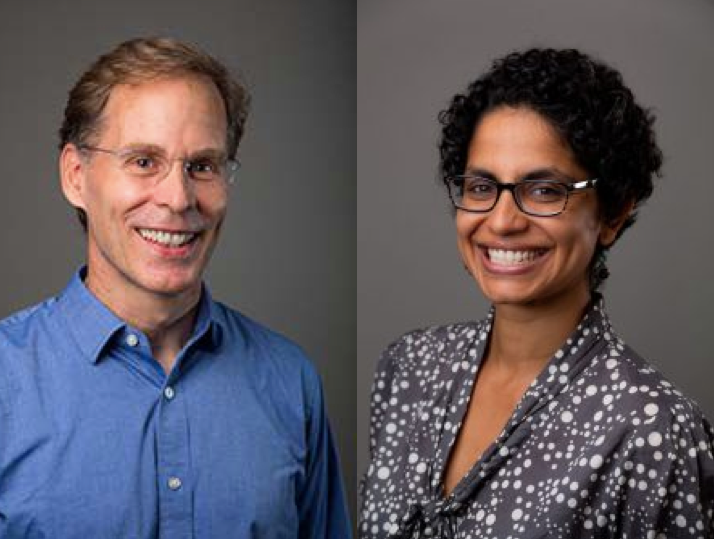

To learn more about the effects COVID-19 could have on graduates, U-News spoke with UMKC professors Dr. Sirisha Naidu, who has taught economics for 14 years, and Dr. Erik Olsen, who has taught economics for 24 years.

Q: COVID-19 has had a huge impact on businesses both big and small. In your opinion, how will COVID-19 affect the job market for 2020 graduates?

Naidu: It will depend on government policies. If policies only focus on ensuring that businesses don’t lose profits, then the benefits will not reach 2020 graduates or those who lost jobs during the pandemic. On the other hand, if government policies support those businesses and industries that create jobs that are well-paying and offer decent wages, then the job market would steadily improve for everyone.

Olsen: The partial shut-down of the U.S. economy as a result of social distancing requirements will significantly adversely affect the job market for 2020 graduates. Because most industries are facing a significant decline in the demand for their goods or services, they need far fewer employees, if any, to operate their business. Some businesses are also unable to get the inputs they need to produce their product. Social distancing will eventually end, but the impact on both the demand and the supply side will continue beyond this.

Q: Are there any majors that you think might be impacted more than others because of COVID-19?

Naidu: The pandemic has affected most industries and professions. There are a few industries that have profited significantly from this crisis, but the beneficiaries operate in the higher positions of the organization. Recent graduates applying to work in these industries may not benefit to the same degree. So, the pandemic will affect all majors negatively unless there are specific policies put in place to encourage creation of well-paying jobs. All of us should demand these policies of our legislators.

Olsen: Students in health sciences, especially those involved with patient care, will see an improved job market. Most other areas should see varying impacts.

Q: Is there anything that students can do now to prepare themselves for the aftermath of the economy due to COVID-19?

Naidu: For many students this may be a time of extreme anxiety and stress. However, it is also a time to demand that laws and economic policies benefit the regular folks who have been disproportionately impacted by COVID-19. Regardless of our political orientation, most of us seek the same things – a decent life for ourselves, our families and our communities. Additionally, the current economy is not our grandparents’ or parents’ economy. Successful individuals not only have technical skills but practice critical thinking. They question current practices, learn from history and innovate for the future. So, sharpen those thinking skills that a college education fosters.

Olsen: A college education remains by far the best way to improve the opportunities available to someone, and to improve their future earning potential. Higher-performing students have better outcomes on the job market. So, the best way to prepare is to focus on what you can control, which is your own performance in class. In any job market, a student with a high GPA and good recommendations from faculty is going to be considered for a job before a lower-performing student.

Q. Some students may be receiving the $1,200 economic impact payments (stimulus checks). What tips or advice can you give on what to do with that money?

Naidu: The first responsibility is to satisfy basic needs of households: adequate food, shelter, physical and mental health. Repaying debts is secondary.

Olsen: Everyone’s circumstances are different. For some students that check is best-used making sure the rent and utility bills are paid and that there is food in the cupboard. Others might benefit from paying down short-term, revolving debt, [like] credit cards. In general, the best way to use that money is to help get yourself into a better position to succeed at UMKC. A degree will pay dividends for the rest of your life. Distinguishing yourself as a high-achieving student while you are here will also. Using the money towards those goals will help you in the future.

jnjvxf@mail.umkc.edu

aamnx9@mail.umkc.edu